Leaving a legacy gift in your will or trust can make a lasting difference to the Florida Park Service Ranger Association and those who serve Florida State Parks, past and present. Your legacy gift should be thoughtfully planned. Many gifts cost nothing now, there is no minimum contribution, and you are not locked into a decision you make today. Many good planning techniques are available, and you should choose the type of legacy gift that best suits your personal objectives. The Florida Park Services Ranger Association, Inc. encourages donors to consult with their financial and tax advisors before making a legacy gift. Benefits

Some donors prefer to bequeath a certain percentage of the remainder of their estate — the amount that remains after paying all debts, costs, and other prior legacies. Some bequests can be a stated dollar amount, or you can bequeath specific property to the Friends. Whichever form you prefer, you can direct that your bequest be used for the general support of our work or for a specific purpose supporting Florida Park Services Ranger Association. ESTATE PLANNINGMost legacy giving supporters make unrestricted gifts that allow us to use their funds for Florida Park Services Ranger Association's most pressing needs. We are happy to discuss specific ideas you may have for your gift. To make an unrestricted bequest, consider using the following language in your estate plan:

Individuals making legacy gifts via their estate plans are vital to our efforts supporting Florida Park Services Ranger Association. If you plan to include the Florida Park Services Ranger Association , Inc. in your estate plans or already have done so, please contact us. | FPSRA FUND

The Florida Park Services Ranger Association, Inc. has partnered with the Community Foundation of North Central Florida to establish the FPSRA Fund to provide for the long-term sustainability of the organization. These funds are professionally invested under the supervision of local, community-based financial experts who have experience in building and preserving funds in perpetuity. Some donors may prefer the relative long-term security of the Community Foundation. Learn more about the FPSRA Fund and our partnership with the Community Foundation of North Central Florida. |

Thank you for considering a donation to the Florida Park Services Ranger Association which can be designated for a specific fund or purpose, or a general unrestricted donation to the Ranger Association. Please complete the form below. Once your donation is complete a receipt will be emailed.

Checks may be mailed to:

Florida Park Service Ranger Association

3551 Blair Stone Road

STE 128 PMB 113

Tallahassee FL 32301

The Florida Park Service Ranger Association, Inc. is a Florida Not For Profit corporation (EIN 90-1076487) and has been approved by the Internal Revenue Service as a tax-exempt, charitable organization. All or part of your gift may be tax deductible as a charitable contribution. Please check with your tax advisor.

The Florida Park Service Ranger Association is registered with the Florida Department of Agriculture and Consumer Services - Division of Consumer Services. Registration Number: CH58065. A copy of the official registration and financial information may be obtained from the Division of Consumer Services by calling the toll-free, within the state, 1-800-HELP-FLA or going to Check-A-Charity. Registration does not imply endorsement, approval, or recommendation by the state.

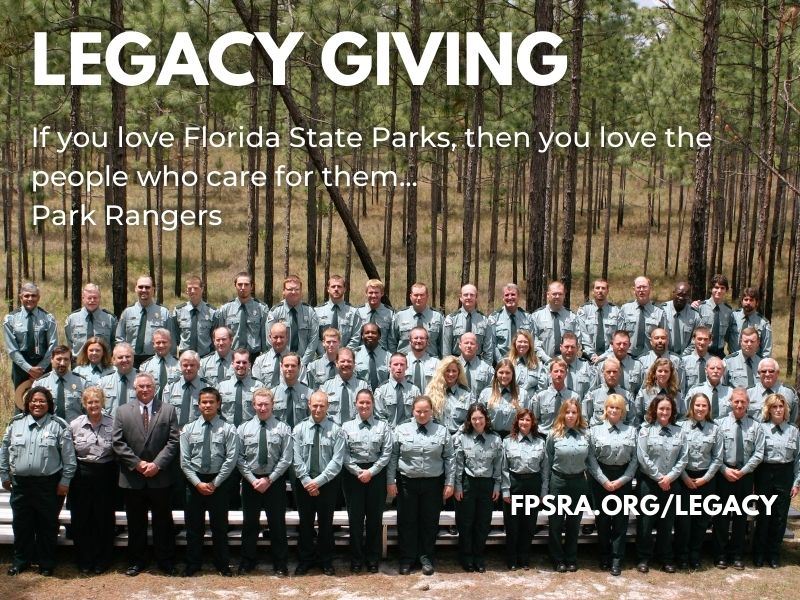

| Mission - Supporting those who serve Florida State Parks, past and present, by providing financial assistance, cultivating a family atmosphere, and perpetuating a spirit of unity and service. Vision - Supporting those who serve Florida's State Parks Motto - Family, Service, Traditions |

.png)